AGOSTINHO & ROCHA (A&R) has specialized professionals and a highly experienced team to attend all its clients in a professional, ethical and fast way, since we know that when the citizen seeks a social security benefit, motivated by urgency, either by the need of the benefit for his and his family’s support, or by the yearning to enjoy the dreamed and deserved retirement after so many years of work.

Thus, the A&R acts in the administrative and judicial spheres, with the Federal Authority (INSS) or competent court, to decide the cause, claiming the rights of the insured, such as concessions and reviews of benefits.

The work of A&R starts with a preliminary consultation when the customer is met face to face, when he expresses his demand and is guided as to the documents necessary to verify his potential rights, until the exhaustion of all legal means to apply for the concession, revision and / or implementation of the desired benefit.

The legal services can be hired from the beginning, still in the administrative level, which can represent a great advantage to the beneficiary, considering that the most advantageous option will be chosen to approach INSS.

A&R customers have a fully equipped office to take all legal measures to deal with the matter quickly and efficiently, assisting the client, including in the INSS hearings and medical examinations.

The main problems encountered by the insured when claiming benefits alone with the INSS are:

A&R is always updated and active in the face of changes in social security legislation and in the understandings of the Courts of our country.

You can also be benefited with service of excellence you deserve!

Social security benefits are paid as a result of being linked to the Social Security System.

Let’s talk a little about the General Social Security System (RGPS), which is linked to the National Social Security Institute (INSS): The enrollment to the General Social Security System may be mandatory or optional.

It is obligatory for those who have paid jobs and, optionally, for those who do not exercise it, but want to guarantee the possibility of being entitled to some benefits, such as, retirement.

By the affiliation, the citizen assumes the obligation to pay contributions and, in return, acquires the right to receive benefits, after fulfilling the legal requirements, each one individually.

We can divide the insured into six different categories, of which five are compulsory (employee, domestic servant, individual taxpayer, single worker and special insured) and only one optional (optional insured).

Let’s take a closer look:

It is considered employee:

It is considered a domestic employee, one who provides continuous service to the person or family, in the residential area, in non-profit activities. Examples of domestic servants are: butlers, housekeepers, gardeners, drivers, etc.

It is considered an individual taxpayer:

A single worker is by definition one who, provides services to several companies, without employment relationship, of urban or rural nature, as defined in the Social Security Regulation.

A special insured is by definition one who:

An optional insured person is one who joins the General Social Security System, through contribution, provided that he does not fit as insured in the other categories.

A) RETIREMENT:

What it means?

Retirement for contribution time is a right of the insured who contributed to the Pension Plan for a period determined by law, that is, thirty-five (35) years for men and thirty (30) years for women.

The criteria for granting it t is merely the time of contribution.

Does retirement by contribution time depend on age?

Although we are faced with a scenario of changes in Social Security System, today there is still no minimum age for this type of benefit, it is enough for the worker to prove the time of contribution and service, as for the time described above.

But, this kind of benefit has the incidence of something called SOCIAL SECURITY FACTOR, which can reduce the value of retirement when pleading at a young age, that is, the younger you are, the greater the incidence factor will be.

Got worried?

Don’ t get discouraged. You can escape from the social security factor through the so-called “rule of points” or “progressive formula.” This is the sum of points, which takes into account the age of the insured and the time of contribution to try to move away the social security factor.

The law established a progressive rule, which would increase the necessary score periodically. When the rule began, the required score was 85/95 (85 points for women and 95 points for men). The formula will follow the progression below in the coming years:

86/96: from December 31st 2018;

87/97: from December 31st 2020;

88/98: from December 31st 2022;

89/99: from December 31st 2024;

90/100: from December 31st 2026.

From 2026 there is no further progression, reaching the maximum limit of the formula (90/100).

What is proportional retirement?

The proportional retirement is a variation of the retirement by time of contribution, being a modality extinguished in 1998.

However, because of the transition rules, some people may still benefit from this modality. It’s rare, but it happens.

This modality allowed a reduction of 5 (five) years in contribution time, but, on the other hand, the value of the benefit was reduced. There was also a requirement of cumulation of contribution time with the criterion of age (53 years of age, if male and 48 years of age, if female).

The value of the benefit from the use of this rule is often harmful, because in addition to having a reduction of 30% in relation to the value of full retirement, you will also have the application of the social security factor, which will further reduce it. In addition, the transition rule requires the enforcement of a toll, which would be added to the time that the insured would have to work.

The toll fixed by the transition rule is 40% of the time that was lacking for proportional retirement in 1998. For example, if the insured had 5 (five) years for proportional retirement, he would have to meet this missing time and plus 2 (two) years (representing 40% of 5 years) as a toll, having to work for 7 (seven) years to receive proportional retirement.

Over these five (5) years that was missing, the transition rule requires the enforcement of a toll, an extra time due to the change of law. The toll is 40% of the time needed for proportional retirement in 1998. For João, that means 40% more of the 5 years that were lacking for proportional retirement, which gives 2 years more.

In this sense, the assistance of a lawyer allows the insured to know if there are transition rules to be applied and also the advantages and disadvantages of making use of them, and we can advise you the best time to apply for the benefit.

What are the advantages of looking for a lawyer?

With the help of a lawyer, you can avoid losses by being warned about when and what to apply in order to choose the best time to apply for your retirement, avoiding losing money with hasty requirements (before you should apply and therefore having significant reduction of value) or after time (contributing unnecessarily to Social Security System).

There are numerous details that must be observed for the feasibility of granting the benefit, such as the possibility of inclusion of the rural work period, even without payment of contribution; the possibility of using the time worked in special called conditions (exposed to health risk agents or physical integrity), to increase the count in the time of contribution; the analysis of the alternative of retirement by points; the possibility of proportional retirement, although very rare these days; the incidence of the social security factor, and several others, that a good legal advice can help you with.

Good to know:

• The employer is the one who has the obligation to make the payments to Social Security fee on behalf of the employee and therefore, even if he has not made the payments, the employee has the right to have included in his time the whole period of the employment bond;

• You have the right to receive the best benefit, that is, the most advantageous, being the duty of the INSS server to guide you accordingly;

• If you collect the Social Security contribution with the wrong code you can have many problems to recognize the period you want;

• The interim period in which the insured was in sickness aid is counted as contribution time.

What it means?

Special retirement is an entitlement of the insured person who has worked under special conditions that adversely affected health or physical integrity, for 15 (fifteen), twenty (20) or twenty-five (25) years, as provided by law.

The criteria for granting

What are these special conditions?

These special conditions are described in the legislation.

Until April 28th 1995, the framework was done by PROFESSIONAL CATEGORY, that is, once the exercise of a particular profession described in the law as being subject to risk exposure was proven, it was possible to fit the insured to receive the right to special retirement.

Between April 29th 1995 and March 05th 1997, the calculation began to occur through proof of both the time worked, as well as the effective exposure to harmful agent. Thus, a mere demonstration of the exercise of the activity was no longer sufficient. Some special forms were required, except for exposure to the noxious noise agent, which was evidenced by technical report.

From March 06th 1997, the proof of exposure to harmful agent through own forms became more rigorous, requiring compliance with specific requirements, with issuance by the company of a Technical Report on Environmental Working Conditions (LTCAT) , issued by the occupational physician or occupational safety engineer.

The noxious noise agent, which allowed framing when it was above the tolerance limits described by the law, was also the subject of successive legislative changes. Until April 03rd 1997, the limit was 80 decibels; between April 06th 1997 to November 18th 2003, it was 90 decibels and; as of November 19th 2003, has become 85 decibels, in force until now.

Today, two documents are very important: PPP (Professional Social Security Profile) and LTCAT (Technical Report on Environmental Working Conditions).

Know that the framework is checked according to the law in force at the time. Couldn’t you understand? We will explain: suppose you have worked your whole life as a truck driver or a doctor. Today, you intend to plead for special retirement. When examining your application, the whole period prior to 1995 will be framed by the simple proof that you have practiced the mentioned profession, by means of the presentation of the Work Permit Booklet (CTPS), while the period after 1995 must be proven through the forms PPP ‘and LTCAT’s, according to the new law demanded in that time.

What is Special Retirement by Profession?

Each profession has its characteristics that alter the requirements and grant advantages to the professional at the time of retirement and other benefits.

Truck Driver – Retirement of truck driver is characterized as special retirement, since it is developed in conditions of insalubrity and dangerousness, that changed in April 28th 1995.

By that date, a truck driver who had a category C driver’s license would have had work time considered as unhealthy, since at that time any heavy vehicle – bus or truck – was full of unhealthy features. To give you an idea, the driver’s leg was exposed to artificial heat, higher than normally tolerated by the body, as well as noise much higher than the limit established as safe because of engine noise.

However, at that time the vehicles began to be modernized and such conditions to be extinguished. As of April 28th 1995, only the time of activity of those truck drivers with a category E driver’s license was considered unhealthy, since they worked long distances to highly dangerous and flammable agents.

This type of benefit has two major advantages: the unhealthy professional can retire with only 25 years of contribution (in this type of work) and, when applying for the benefit, there will be no reduction in value because of age, that is, there is withdrawal from the social security factor.

Dentist – The retirement of a dentist is characterized as special retirement, since it is done under unsanitary conditions, to the detriment of their physical integrity. By his profession, the dentist has daily contact with viruses, bacteria and even with radioactive equipment, agents that put his health at risk.

Advantages: the unhealthy professional can retire with only 25 (twenty-five) years of contribution (in this type of work), and when requesting the benefit, there is withdrawal from the social security factor.

To ensure the achievement of special retirement, the professional must meet the PPP and LTCAT of the companies in which he worked. If you are self-employed, you must produce proof by hiring an engineer or work doctor.

Also for those professionals who want to retire, but do not intend to stop working, it is possible to convert the unhealthy time into common time and retire considering Retirement for Contribution Time. Recently, new decisions have also allowed for special retirement, without the need for conversion and the continuity of unhealthy activity.

Eletricians – The retirement of electricians, who works exposed to high voltages (above 250 volts), is characterized as a special retirement, since it carries out its activity in unsanitary conditions, to the detriment of its physical integrity.

Advantages: the unhealthy professional can retire with only 25 years of contribution (in this type of work) and, when requesting the benefit, there is withdrawal from the social security factor.

To guarantee special retirement, the professional must gather the PPP and LTCAT of the companies in which he worked. If you are self-employed, you must produce them by hiring an engineer or work doctor. Also, for those professionals who want to retire but do not intend to stop working, it is possible to convert the unhealthy time into common time and retire considering Retirement for Contribution Time. Recently, new decisions have also allowed for special retirement, without the need for conversion and the continuity of unhealthy activity.

Entrepreneur – The entrepreneur belongs to the group of individual taxpayers, linked to the General Regime of Social Security as compulsory taxpayers of the system. In the condition, this group of insured persons must contribute to the INSS and be entitled to the same benefits, especially the retirement.

The retirement of the entrepreneurs has the same rules of the other professionals, with the same requirements and formula of calculation of the value of the benefit.

However, the entrepreneur’s relationship with Social Security is different from other professionals, since he himself must manage and collect his own contributions to the system, which requires a lot of planning and strategy to predict the future retirement benefit, always aiming to obtain the best results.

It is possible to regularize these periods for the calculation of contribution time and salaries in the granting of retirement. However, it is necessary to be careful, since the INSS makes an illegal calculation, without respect to the law and the decision of the Supreme Court of Justice (STJ), which defined by the illegality of the collection of interest arrears and fine in periods prior to November 1996. This illegal collection is easily removed in court and reduces, by up to 70%, the amount charged by the INSS.

It is important to pay attention to the following tips so that you can make the most advantageous retirement after years of work and contribution:

• If you are planning to retire in the next 10 (ten) years, seek a specialized lawyer to make good planning, avoiding excessive recalls or a reduced value benefit;

• If you are planning to retire in the next 18 (eighteen) months, count the contribution time and mark in your schedule the exact day that will complete the required time. The benefit is granted from the date of scheduling of the request;

• If you have two companies or one company and another self-employed activity for a concomitant period and have not collected at the maximum contribution, check this possibility to increase your salary;

• If you have completed the time required for retirement (35 years of contribution, if male and 30 years old, if female), it is not worth continuing to contribute as it will hardly increase the value of the benefit.

Engineer – Retirement of the civil engineer is undoubtedly the most beneficial modality of retirement, since he exercises his activity in unhealthy conditions, to the detriment of his physical integrity.

Advantages: the unhealthy professional can retire with only 25 years of contribution (in function) and, when requesting the benefit, there is a withdrawal from the social security factor.

To guarantee special retirement, the professional must gather the PPP and LTCAT of the companies in which he worked. If you are self-employed, you must produce them by hiring an engineer or work doctor.

Also, for those professionals who want to retire, but do not intend to stop working, it is possible to convert the unhealthy time into common time and retire considering Retirement for Contribution Time. Recently, new decisions have also allowed for special retirement, without the need for conversion and the continuity of unhealthy activity.

Nurse – The nurse’s retirement is characterized as special retirement, since it is developed in unsanitary conditions, to the detriment of their physical integrity.

Through his profession, the nurse has daily contact with viruses, bacteria and even with radioactive equipment, agents that put his health at risk.

Advantages: the unhealthy professional can retire with only 25 years of contribution (in function) and, when requesting the benefit, there is a withdrawal from the social security factor.

To guarantee special retirement, the professional must gather the PPP and LTCAT of the companies in which he worked.

Also, for those professionals who want to retire but do not intend to stop working, it is possible to convert the unhealthy time into common time and retire considering Retirement for Contribution Time. Recently, new decisions have also allowed for special retirement, without the need for conversion and the continuity of unhealthy activity.

Doctor – Retirement of the doctor is characterized as special retirement, since he exercises his activity in unhealthy conditions, to the detriment of his physical integrity.

Through his profession, the doctor has daily contact with viruses, bacteria, radioactive equipment and agents that put his health at risk.

Advantages: the unhealthy professional can retire with only 25 years of contribution (in function) and, when requesting the benefit, there is a withdrawal from the social security factor.

To guarantee special retirement, the professional must gather the PPP and LTCAT of the companies in which he worked. If you are self-employed, you must produce them by hiring an engineer or work doctor.

Also for those professionals who want to retire, but do not intend to stop working, it is possible to convert the unhealthy time into common time and retire considering

Retirement for Contribution Time. Recently, new decisions have also allowed for special retirement, without the need for conversion and the continuity of unhealthy activity.

Metallurgist – The retirement of metallurgist is characterized as a special retirement, because it is developed in conditions of insalubrity, in detriment to its physical integrity. Among the unhealthy conditions are noise above the established healthy limit, conditions of excessive heat from artificial sources and exposure to chemical agents exhaled from metallurgical processes. This professional is exposed to numerous situations of danger of death, in a habitual and permanent way.

Advantages: the unhealthy professional can retire with only 25 years of contribution (in function) and, when requesting the benefit, there is a withdrawal from the social security factor.

To guarantee special retirement, the professional must gather the PPP and LTCAT of the companies in which he worked. If you are self-employed, you must produce them by hiring an engineer or work doctor.

Also for those professionals who want to retire, but do not intend to stop working, it is possible to convert the unhealthy time into common time and retire considering Retirement for Contribution Time. Recently, new decisions have also allowed for special retirement, without the need for conversion and the continuity of unhealthy activity.

Security Guard – The Supreme Court of Justice (STJ) has recognized the right to special retirement time for security guards and private security, regardless of whether they work armed or not.

To obtain the right to special retirement for security guards it is necessary to prove 25 years of harmful activity. Since special retirement does not affect the social security factor, in addition to needing less time of contribution, the retirement happens to have a value greater than the normal retirement, being, therefore, integral value paid.

Those who do not have 25 years of special activity, can convert the proven period as a private security in common time and add to the other contributions.

For those who work as armed security, the proof of the activity with the carrying of the weapon is given through a company statement, which appears in the PPP issued by the company’s Human Resources department. It is also important to present the gun registration, to be included in the special retirement process for security guard.

It is common for companies to fail to state in the PPP, expressly, that the security used a firearm. What should be rejected, returned the document to the company for correction, not being delivered incomplete to the INSS.

It is also possible that the security guard can add unhealthy activities, to other activities he has exercised in order to reach 25 years and receive special retirement.

What are the advantages of looking for a lawyer?

The lawyer knows the numerous laws and decrees law that deal with the activity carried out under special conditions subject to harmful agents and, therefore, knows if the profession that you exercise entitles you to the framework. In addition, it will guide you properly regarding the necessary documents and where to obtain them.

In cases where the client cannot obtain the forms and reports, (such as when the employer terminated his activities), the lawyer must use legal mechanisms to prove the specialty of the activity, according to the understanding of the Courts.

Good to know:

• Exposure to harmful agent must be permanent. It cannot be intermittent and / or eventual;

• Even if you use the protective equipment, the noxious noise agent above the tolerance limits gives right of framework;

• Even if you do not get special retirement, because you have not proven the 15, 20 or 25 years required by law, the periods that can be considered and can be converted into ordinary time to give you retirement for contribution time.

What it means?

The retirement by age, different from the retirement by time of contribution and special contribution, has by main criteria the age.

For urban workers, it will be granted to the man who completes 65 (sixty-five) years of age and the woman who completes 60 (sixty) years of age.

To rural workers, it will be granted to the man who completes 60 (sixty) years of age and the woman who completes 55 (fifty-five) years of age. That is, a reduction of 5 (five) years in relation to urban workers.

But it is not enough to complete the age, it is also necessary to fulfill the requirement of the GRACE PERIOD. The grace period is a minimum number of contributions that the worker must have to retire by age.

Unlike pensions whose criterion is the contribution, age retirement requires a shorter contribution period, that is, 180 (one hundred and eighty) months, which corresponds to 15 (fifteen) years.

The workers, as a rule, must prove the contributions of the 180 (one hundred and eighty) contributions. But there are exceptions, rural workers and artisanal fishermen, working in a family-run economy (with the help of the family) or individually, can receive the benefit regardless of contribution, and it is only up to them to prove the actual rural labor for time corresponding to the grace period.

It is important to know that in order to take advantage of the reduction of the age in rural retirement and the payment of retirement contribution, he cannot have employees, exercise another type of activity, have another source of income that makes rural work unnecessary, or own large rural property.

What is hybrid retirement?

The “hybrid” or “mixed” retirement is a variation of the retirement by age, differentiating itself by the fact that, in this modality it is possible to add the time of urban and rural activity to determine the lack, regardless of the order in which they were exercised.

The age to apply for this type of retirement is 65 years of age, if male and, 60 years old, if female, on the date of entry of the application for retirement.

The grace period remains the same (180 contributions), but now can be added the rural period with the urban, regardless of which was exercised first or last.

What are the advantages of looking for a lawyer?

The lawyer helps you to know if the number of contributions you have is sufficient and, if there is some time missing to meet the need, in which category you should contribute.

In the case of rural workers, it is even more important to have the help of a lawyer, since the worker hardly knows or remembers what documents can prove the rural labor and where it is possible to find them.

Good to know:

• Even if you do not have a job or profession, it is possible to make a contribution to the Social Security to reach the grace period as an OPTIONAL CONTRIBUTOR;

• Rural workers and artisanal fishermen, who work on a family economy basis, with the assistance of the family or individually, are called special insured person;

• The special insured worker must be exercising the activity in this condition, when he requests the benefit.

What it means?

Retirement due to invalidity is a right of the insured who, whether or not receiving sickness aid, is considered incapable and unable to rehabilitate for the exercise of activity that guarantees the subsistence.

The criteria for granting this type of pension is total and permanent incapacity for work. As long as the insured remains in this condition, the benefit must be paid.

Is there a grace period for this kind of benefit?

The grace period (minimum number of contributions to qualify for the benefit) for this type of retirement is, as a rule, 12 months of contribution.

But the law provides exemption:

• When the request for granting the benefit arises from an accident of any nature, including work;

• When the insured, after joining the INSS, is affected by any of the diseases or conditions described in the law (active tuberculosis, leprosy, mental alienation, malignant neoplasia, blindness, irreversible and incapacitating paralysis, severe heart disease, Parkinson’s disease, spondyloarthrosis ankylosing spondylitis, severe nephropathy, advanced stage of Paget’s disease, Acquired Immune Deficiency Syndrome (AIDS), radiation contamination, severe liver disease).

What are the advantages of looking for a lawyer?

The lawyer knows which documents are important for proving the disability and can make the necessary arguments, against the report that the expert will present.

Good to know:

• If the incapacitating illness precedes enrollment in Social Security System, it will not be possible to grant the benefit, unless the disability results from the progression of the disease;

• This benefit may be terminated if it is found that the once disabling and permanent framework has changed and the worker is considered fit for work;

• In some cases, depending on how long the insured has been receiving the disability benefit, any termination cannot occur overnight. The INSS must respect the gradual reduction of the benefit;

• An invalid retiree who needs permanent assistance from another person may claim an increase of 25% in the amount of his benefit, including on the 13th salary.

HANDICAPPED

There are people who have some kind of disability that, according to the law (in verbis):

[…] they impose long-term physical, mental, intellectual or sensorial impediments which, in interaction with various barriers, may obstruct their full and effective participation in society on an equal basis with other people.

Faced with this reality, Complementary Law No. 142/2013 established that the time of contribution or age for these people to retire would be reduced.

In the case of retirement by contribution time, the reduction would follow the following scale:

• At 25 years of contribution time, if a man and, 20 years of age, if a woman, in the case of an insured with a severe disability;

• At 29 years of contribution time, if a man is 24 years old, if a woman, in the case of an insured with moderate disability;

• At 33 years of contribution time, if a man and, 28 years of age, if a woman, in the case of an insured with a mild disability.

When it comes to retirement by age:

• At the age of 60 years old if a man, and at age of 55 years old if a woman, doesn’t matter the degree of disability, provided that a minimum contribution time of 15 years has been met and the existence of disability has been proven during the same period.

The condition of deficient will be attested by medical expertise. The law also establishes other criteria to be observed to grant the benefit.

Differences Between Disability Pension and Early Retirement because of Disability:

B) SICKNESS AID

The sickness aid is a benefit granted to the insured person who becomes incapable to work or perform his habitual activity for more than fifteen (15) consecutive days as a result of illness or accident.

This incapacity is total and temporary, that is, the insured is absolutely unable to exercise his activity, but on the other hand, he is expected to recover within a certain period. The sickness benefit may be common or caused by an accident.

The differences between them can be seen in the table below:

C) AID-ACCIDENT

It is a benefit granted as indemnity to the insured who suffered some type of accident and remained with sequels after the consolidation of the injuries, in addition to having reduced the capacity for the work that usually exercised.

This benefit is quite different from sickness aid or disability pensions, because there is no total incapacity, but only a reduction in capacity, without this implying an impediment to the exercise of work.

The sequel partially affects the insured’s working capacity.

Since it is not a substitute benefit of the insured’s income, his or her concession may be less than the minimum wage.

The benefit will be granted after the transfer of the sickness aid (a period in which the sequels are not supposed to be consolidated) and cannot be accumulated with retirement, and on the other hand, it can be cumulated with any other type of benefit.

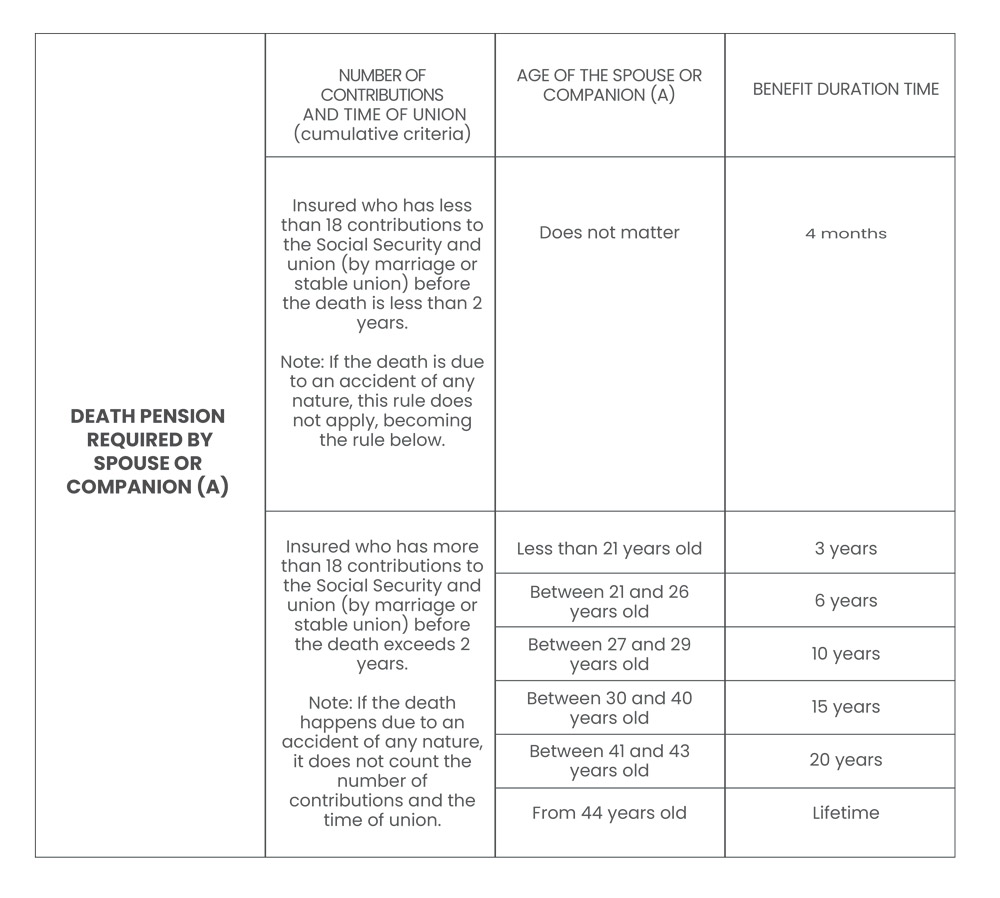

D) DEATH PENSION

It is a benefit granted to dependents of the insured person who dies, retired or not, who exercised his activity in urban perimeter.

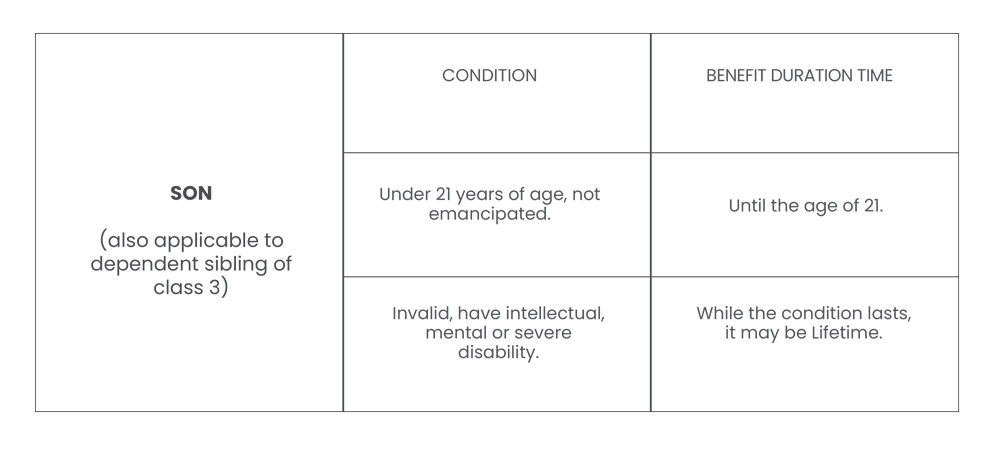

The benefit will initially be granted to so-called “class 1 dependents”, namely: spouse or partner and to the non-emancipated child, of any condition, less than twenty-one (21) years of age or disabled or who has intellectual or mental illness or severe disability.

The economic dependence of this class is presumed and, therefore, no proof is needed.

If there is no one in class 1, it will be granted to the parents of the deceased, which constitute class 2. Lastly, if there is no qualification in the previous classes, it will be granted to the brother not emancipated, of any condition, less than twenty-one years old or invalid or who has intellectual or mental illness or serious disabilities.

The granting of the benefit to the people described in classes 2 and 3 depends, necessarily, on proof of economic dependence, because if not proven, the benefit will not be granted. In order to be entitled to the benefit, it must be proved that the insured was affiliated to Social Security and, at the time of death, still maintained the status of insured.

Several factors influence the duration of the benefit:

• The amount of contributions of the deceased insured;

• The type of beneficiary;

• The age of the beneficiary.

The tables below may help you understand these factors:

Good to know:

• There is a possibility of accumulation of the pension for the death of a partner or spouse with the pension left over from the death of a child;

• A dependent convicted of committing an intentional crime, which resulted in the death of the insured, after a final decision, shall not be entitled to the benefit.

OTHER INFORMATION ON PENSION WAGES

The value of the benefit of each insured person is different, since it depends on their contribution to the Social Security System.

However, the legislation determines a maximum and minimum limit on value. Certain benefits may not be below or above the established limits.

There are exceptions to the minimum benefits, since it applies only to benefits that are substitutes for worker’s income, such as, retirement, sickness aid and death benefits.

In cases of benefits that are not of this nature, such as accident aid, which is merely indemnifying and the worker is not prevented from continuing working and having his income, the value of the benefit can be paid below the minimum.

The limits are fixed, but variable values. Could not understand? It is easy.

The minimum benefit is the minimum salary, that is, when it comes to the substitutive benefit of income, no one can receive less than the minimum wage. But we all know that the minimum wage increases a little bit every year. Therefore, the limit (minimum wage) is fixed, but the value (which changes every year) is variable.

Likewise, the maximum contribution. No benefit can overcome the so-called Social Security Maximum Benefit. The maximum benefit is adjusted annually and, in the year 2019, for example, was R$ 5,839.45. This implies that no one can receive benefit greater than this value.

The social security factor is the “bad guy” of retirement.

It does not prevent people from retiring at a young age, but imposes a high price by decreasing the amount to be received by the insured. In other words, the sooner you retire, the lower your retirement earnings will be.

Some variables are considered in this equation:

• Life expectancy: the higher, the worse the social security factor;

• Age: the younger, the worse the social security factor;

• Contribution time: The greater the better the social security factor.

The life expectancy of the Brazilian has increased in recent years, which worsens the formula of the social security factor. In this sense, it is up to the insured to try to reduce the loss through the other two factors, that are, the age and the time of contribution.

From this perspective, retirement by the rule of points may be a good option.

Each benefit has its own documental requirements, but we will try to help you with some suggestions:

Regardless of the benefit you wish to claim, you will always be required to present:

• Identity Card or other identification document (Driver’s license, for example);

• Social Security Number – CPF;

• Proof of residence;

• Work Permit Booklet (if you have more than one, you must take all of them);

• Social Integration Program (PIS) or Public Server Patrimony Formation Program (PASEP) or Worker Identification Number (NIT).

Important documents to prove the grace period:

Urban:

It depends on the type of insured you are, but strictly the main documents are:

• Work Permit Booklet, if employed;

• Contribution card if self-employed;

• Original or authenticated copy of the Employee Records Sheet, if employed;

• Individual Work Contract, if employed;

• Term of Termination of Employment Contract, if employed;

• Service contracts, if autonomous;

• Others.

Rural:

Proof of the rural activity is through documents in the name of the insured or members of the family, which includes the exercise of rural activity or artisanal fisherman. Examples of useful documents include:

• Contract of lease, partnership, mediation or rural lending;

• Birth, marriage or stable marriage certificates, among others, that inform the profession related to rural work or artisanal fishing;

• Declaration or proof of attachment to the rural union or fishermen’s colony;

• Rural producer notes;

• Sales notes of the production or commercialization of products;

• Voter registration or electoral registration form;

• Certificate of enlistment or discharge with military service;

• School registration forms, minutes and bulletins;

• Vaccination card;

• Bank, hospital or other documents that inform the rural profession;

• Proof of registration of the National Institute of Colonization and Agrarian Reform (INCRA);

• Proof of payment of contribution to Social Security;

• Copy of the Income Tax declaration;

• Proof of payment of Rural Territorial Property Tax.

Documents for tax debt collection, in the case of an individual taxpayer:

• Receipt of service provision;

• Service agreement;

• Income tax declaration;

• Registration of profession in the City Hall;

• Payment of Service Tax;

• Any document that indicates the exercise of the profession.

Documents to prove activity carried out under special conditions (insalubrity / dangerousness / exposure to harmful agents):

• PPP and LTCAT;

• Old forms, for example, DSS-8030;

• Evidence loan, for example, paradigm reports.

Documents to prove military service time

• Veterans or Military Board Certificate.

Documents to prove the period worked under its own regime:

• Contribution time certificate issued by the competent body of the proper regime.

The Continuous Benefit (BCP) is a welfare benefit – not a social security benefit -, aimed at the disabled person and the elderly, which proves that they do not have the means to provide for their own maintenance or have it provided by their family, and is described in art. 203, item V, of the Federal Constitution.

The Organic Law of Social Assistance (LOAS), Law No. 8,742 / 93, regulates the concession of the benefit and establishes the criteria for its approval.

Because it is not a social security benefit, there is no need to talk about contributions to Social Security. On the other hand, he does not have a 13th salary or generate a pension on death.

Any citizen who is disabled or elderly can claim the benefit, provided that proves that they do not have the means to maintain or be .maintained by their family. An elderly person is considered to be one who is 65 (sixty-five) years of age or older. In order to be entitled to the BPC, the beneficiary and his / her family must be registered in the Single Registry of Social Programs of the Federal Government (CadÚnico), in order to process the benefit. Important notes:

• It is forbidden to accumulate BPC with social security benefits;

• The elderly can receive the benefit even if living in an asylum or nursing home;

• Benefit of minimum income already granted to a family member will not enter into the calculation of family income, in case of request of a new benefit (PCB) for another elderly person of the same family;

• To verify the state of miserability/ necessity, the total income of the family members will be checked, except for the hypothesis described above. BENEFIT

Agostinho & Rocha Law Firm (A&R) office works with several types of pension benefit review, seeking to improve the client’s retirement income. Here are some types of reviews:

This is the revision that aims to recalculate the Initial Monthly Income (RMI) from the benefit most advantageous to the insured. Sometimes, the insured implements requirements that allow two types of verification of his RMI and, the one granted by the INSS ends up being the most harmful. In this sense, we seek the revision to determine the concession of the best benefit.

Who is entitled to the Review?

Those who have implemented the requirements for granting the most advantageous benefit or under the most advantageous condition, prior to the Benefit Start Date (DIB) of the benefit actually perceived.

Many workers serve more than one company. In this case, the employee’s contribution will be demanded on the totality of his income, that is, the sum of all wages, respecting the maximum contribution of social security. However, sometimes, when the Federal Government (INSS) grants a desired benefit, it does not pay the corresponding contributions, but only on one of the jobs separately.

If, for the purpose of contribution, all wages received in the month are taken into account, the same criteria must be used to calculate the benefit salary, according to isonomy.

Who is entitled to the Review?

Insureds who contribute to more than one economic activity simultaneously, provided they do not make contributions on the maximum contribution in one of them.

The purpose of the review is to readjust the calculation of the insured’s contribution time in cases where the INSS deliberately failed to recognize the exercise of activity under special conditions and, therefore, did not grant special retirement or failed to convert the special time in common, causing injury in the calculation of the insured’s RMI.

Who is entitled to the Review?

Insured person who have worked hours under special conditions, not recognized by the INSS, on the occasion of the granting of retirement for contribution time.

The purpose of the review is to increase the value of the insured’s income by redefining the initial date of their benefit. This occurs when the insured, although, has implemented retirement requirements, continues to work, generating a difference in RMI calculated on the date he met the retirement criteria and the date on which he formally pleaded. In this context, it is intended to provide the insured with the choice of the most beneficial.

Who is entitled to the Review?

Insured persons who implemented the requirements for retirement when they remained working without claiming the benefit, being entitled to the calculation of the RMI at the time most beneficial to them.

The regulation of retirement by disability provides for the payment of an additional 25% of the amount of the benefit, to the retiree who needs permanent assistance from another person, including the 13th salary.

The revision intends to extend this gift to other benefits, by the principle of isonomy.

Who is entitled to the Review?

Retirees who need permanent support from third parties.

The review seeks to review the value of pensions and death pensions by increasing them by including the amounts received as accident aid in the salaries used to calculate the RMI.

Who is entitled to the Review?

As the supplementary aid was extinguished by the Social Security Benefits Act (LBPS), only retired pensions may be subject to revision.

As for the accident aid, only pensions granted after November 11th 1999 (date of publication of Provisional Measure No. 1596-14) may be revised. It is worth noting that the review is possible in the death pensions granted up to Law 9,032 / 95, if the death occurred for reasons other than the one that originated the granting of the accident aid, including this in the calculation of the RMI.

Constitutional Amendments No. 20/98 and No. 41/03 increased the social security maximum benefits, and the Social Security Agency (INSS) mistakenly applied said maximum benefits for some granted after the increase.

Who is entitled to the Review?

The thesis is applicable to the benefits granted prior to the validity of said Amendments, in which the real benefit salaries were above the social security maximum benefits, in force in the DIB.

It seeks the revision, the integration of the 13th salary (Christmas bonus) and the additional vacation, in periods when the law determines, but that the INSS irregularly fails to consider them.

Who is entitled to the Review?

Considering the incidence of decadence dealt with in art. 103, of LBPS, only the death pension benefits derived from benefits prior to the publication of Law 8,870 / 94. However, who contributed to the maximum value in the months of December will not be entitled to the increase.

We reviewed the pensions granted to teachers, in the hypotheses in which there was a reinforcement of social security factor in the calculation of the benefit salary, seeking to rule out their application.

Who is entitled to the Review?

Currently the issue has not yet been decided by the Federal Supreme Court (STF), which was foreshadowed by the absence of general repercussions.

If you need any help, please feel free to contact us. We will contact you within 1 business day. Or if it’s urgent, call us now.

Ligue :

+55 (44) 3045-5090

previdenciario@agostinhoerocha.adv.br Monday till Friday 09AM to 06PM